The Video Games Supply Chain from 1994

December 10, 2019, at 02:50 AM (2 comments)

Title: The Video Games Supply Chain from 1994 Author: mgarcia Date: 2019-12-10 12:50 +1100 Tags: 2019, Industry, Pics, GameDev, Blog Comments: Open

The Video Games Supply Chain from 1994.

I'd like to introduce this article by James Cooper from 1994, I've read it a few times now and I always pick up something new. It's a very long and detailed look into the video games business from the early 90's and has great information that's still valid today.

It starts with a look at the retail 8-bit, 16-bit, 32-bit consoles and PC video games landscape from both a customer's and developer's perspective as it was in early 1994, it reads very historic and nostalgic now but it was a relevant introduction then, but it can be skipped over to "to Which Comes First?". After that it goes down the supply chain (from the stores back to design and implementation) in detail, focusing more on development business.

Here are a few things that stuck with me:

- Cartridges can extend the hardware features of a console.

- How much of being a pioneer is obligation, and how much is opportunity?

- It’s the sales department’s job to push a product into the distribution channel, and the marketing department’s job is to pull the product through.

- Games are like fish. If they sit on the shelf a week, they start to stink.

I arranged a few parts so it makes sense and put the glossary of terms at the end. Well read on or listen to the horrible Text To Speech MP3 (top right options) and be way cool!

Update, 15th Dec 2019, I add 2 more articles from the following issue, "Get Your Game on a CD-ROM" and "Target Your Game: Computer vs. Console", as these were related.

Enjoy.

Mike.

From A Train to Zork: The Business of Game Distribution

From Game Developer Magazine - Premier issue 1994 - Page 22

Once you have a great game, what do you do with it? Finding a distributor in the complicated world of retail is a tricky proposition.

Learn where your best options lie and what to avoid.

by James Cooper.

Click to view original image: 261kb

Nintendo is famous for Mario, the plumber whose name has gone out on over 100 million cartridges. Developers, distributors, and publishers all dream of a Mario that will propel them into success.

Games do not sell themselves any more than they play themselves. People buy them to run on a computer or video game platform from someone who got them from someone else, who may or may not have created them. This process can be confusing, even to many game developers, but it need not be. Unlike books, games run on platforms: either personal computers or dedicated home video game consoles. This is where we begin.

The Video Game World Between 35 and 50 million U.S. homes have a video game console. That number comprises at least 90% of homes with children and from a third to a half of the 95 million households in the country. Nintendo of America almost single handedly recreated today’s home video game industry on the ashes of Atari’s empire, selling more than 34.5 million 8-bit Nintendo Entertainment System (NES) consoles in the U.S. between October 1985 and the end of 1993. That console is nearly obsolete now.

Its immediate successor is the 16-bit cartridge console, sitting in an estimated 25 million homes by the end of 1993. (Not all 16-bit owners have an 8-bit machine; thus the ambiguity over the number of video-gaming households.) Turbo-Technologies Inc. and Sega of America rushed their TurboGrafx-16 and Genesis 16-bit consoles to market in December 1988 and February 1990, well before Nintendo’s Super NES (SNES) appeared in August 1991.

Analyst Lee Isgur of Volpe, Welty & Co. scoffed at the notion that Sega’s 18-month lead could have prevented Nintendo from retaking dominance of the 16-bit market, but he notes that Sega Genesis currently outsells SNES. Nevertheless, Nintendo alone generated sales of $4.3 billion in its 1992 fiscal year out of a total home video game retail market of almost $5.5 billion. Both numbers are undoubtedly at least $1 billion bigger already.

Over 700 titles were released for all video game platforms in 1993. Sales volumes of 100,000 are considered successful and only 20% of games released sell this magic number. Sonic 2 for the Sega Genesis has sold over 5 million copies worldwide. Starfox for the SNES was the first cartridge to ship an initial million units. Mortal Kombat shipped 3 million cartridges within two months of its September 13 Mortal Monday release and will certainly have surpassed 4 million by the new year. Street Fighter II, among all its incarnations and across all platforms, has sold over 8 million cartridges worldwide. Most cartridges sell between 30,000 and 50,000 copies.

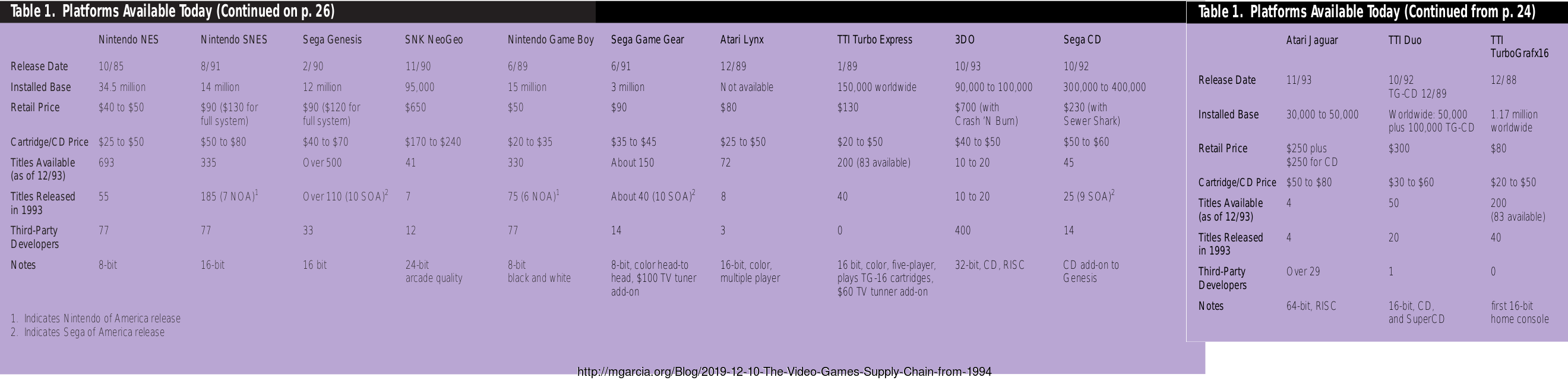

Video games appeal to a younger audience. "The hard-core game-playing public is still 12- to 14-year-old males, so running, jumping, and shooting games are the most popular," says Scott Pelland, editor of Nintendo Power magazine. Indeed, recent figures show action games generate 31% and sports games 27% of total cartridge sales; adventure games is the last major category. Of the sports total, football makes up a full third, basketball a fifth, baseball and hockey an eighth apiece, and boxing and golf each about one twentieth. The proportion of sports sales for the Sega Genesis is higher than for the SNES. Fighting games and what Bob Botch of U.S. Gold calls "critter" games are currently very popular. Table 1 summarizes the platforms available today.

Click to view original image: 261kb

Nintendo reported a ratio of over three cartridges for each SNES platform sold in fiscal 1993; that ratio for the Game Boy was closer to six to one. Nintendo is famous for Mario, the plumber whose name has gone out on over 100 million cartridges. By autumn of 1993, over 1,300 titles had been released and over 313 million cartridges sold for Nintendo’s three platforms: 231 million for NES, 28.5 million for SNES, and 54 million for Game Boy.

The Street Fighter II cartridge for the SNES was available a full year before the Sega Genesis version came out. However, Nintendo’s milder version of a similarly successful arcade game, Mortal Kombat, is being outsold more than two to one by the bloodier, simultaneously released Sega version. Nintendo’s vaunted FX chip, enabling better graphics in 16-bit cartridge games, does not make up for the lack of a Nintendo CDROM-playing add-on.

The Sega mascot is Sonic the Hedgehog, with a higher Q-rating (an indicator of public awareness) among children than any other video game character. A typical Sega Genesis buyer in the U.S. will spend about $255 more on cartridges and peripherals during the first two years, says Ellen Beth Van Buskirk of Sega of America. Sega has a big head start with its CD-ROM Genesis add-on and other peripherals. Distribution has finally caught up to Nintendo’s, too, with nearly 18,000 retail shelves carrying Sega products. Less than half as many publishers support the Sega Genesis, but there are half again as many Genesis titles as there are for the SNES.

Another company, Turbo Technologies Inc. has introduced new technology even more aggressively than Sega. TTI was formed in April 1992 as a joint venture of Japanese hardware giant NEC and $400 million-a-year, Sapporo-based Hudson. A 21-year old technology house, Hudson was the first Nintendo licensee and the first to publish 16-bit CD-ROM software in 1987. Its TurboGrafx-16 or PC Engine is the second most popular platform in Japan behind Nintendo’s Super Famicom, the equivalent of a SNES.

Although U.S. distribution cannot compare to Nintendo and Sega, TTI products are carried by retailers including Toys R Us, Electronics Boutique, and The Good Guys. Working Designs is the only third-party publisher; titles from Namco, Irem, ICOM Simulations, and other developers are released under the Hudson Soft label.

The NeoGeo from SNK Home Entertainment remains the only 24-bit home game console. Literally an arcade machine, it also is unique in allowing players to carry saved games from home to the arcade and back using a memory device the size of a credit card. Only twelve developers are licensed to this platform, and no more are anticipated.

Other CD home entertainment platforms include the Philips CD-Interactive or CD-I, the Commodore CD32 replacing its CDTV, the Tandy Video Interactive Service or VIS, and Pioneer’s new LaserActive. Seven thousand Radio Shacks sell the VIS; the CD32 is the first with a double-speed CD-ROM drive; and the CD-I is backed by one of the largest multinationals in the consumer electronics industry. All are available now for about $400, except the LaserActive. It costs as much as the other three put together, $1,200, and can play either Sega CD or TTI Duo games: to play both costs $1,500. None of the four is clearly targeted at the game market, as the few games in their libraries show, but developing titles for them would provide useful work experience.

Portable video game players make up 15% of the video game industry, according to Atari director of communications Bob Brodie. The 8-bit Nintendo Game Boy and its cartridges are the least expensive and have by far the largest installed base, larger even than any home console. The others offer color. The Lynx and TurboExpress are 16-bit machines. Both Game Gear and Turbo-Express can be turned into portable TVs with tuner accessories costing $60 to $100. Rated best of the portables, TTI’s TurboExpress is the only one to play the same 16-bit cartridges as its home counterpart.

An even newer generation of home video game machines is available now: the 32-bit 3DO Multi-player introduced in October 1993, and the 64-bit Jaguar introduced by Atari over Thanksgiving 1993. Even more impressive than its technology is the business model 3DO advances: no annual limits on the number of titles per publisher, no limits on the source or quantity of production, and licensing fees and production costs at least an order of magnitude lower than what Sega and Nintendo charge. CDs are cheap to make, too: about a dollar each in quantity.

Which Comes First?

This raises the chicken-and-egg conundrum of every computer product: which comes first, hardware or software? Table 1 shows that hundreds of titles are available for the most popular platforms. Yet during 1993, Nintendo itself published only seven SNES cartridges and Sega only 10 Genesis titles. The vast majority of games come from third-party publishers, so-called because they are neither the consumer nor platform manufacturer. Third-party licensees support a platform by publishing cartridges that run on it. Just as platform providers need publishers to field sufficient titles to create demand for their game machines, publishers often enlist independent design houses to execute game development.

Sculptured Software of Salt Lake City is perhaps the oldest and most prolific of these design houses; it has created over 150 titles since 1984 including the SNES Mortal Kombat for Acclaim in 1993. Averaging 20 projects a year, Sculptured Software has developed for the PC, Macintosh, Amiga, Atari ST, and Commodore 64 platforms. Currently, it is only supporting the SNES, Sega Genesis, Sega CD, and Nintendo Game Boy. Founder and president George Metos employs over 70 people and deals with two dozen publishers at any given time.

Alexandria Inc. is another such third-party publisher, developing for the 3DO, SNES, Sega Genesis, and Sega CD, although it is a licensed publisher for none of them. Alexandria president Ken Balthaser comments on the platforms available today: "We’re rooting for 3DO. It’s better for us if there’s a high quality platform out there. It’s less risky, and the royalty is a couple of bucks. It is their technology, but they’re not milking us. Atari is the same, being reasonable about licensing. You can get CDs manufactured locally and in small quantities vs. cartridges from Sega or Nintendo: with a minimum of 30,000 at $10 or $12 per cartridge, you’re talking millions of dollars. Five thousand CDs and a minimal royalty is a whole lot less risk. Following the 3DO model makes it easy on publishers.".

His only complaint is that, for now, "As a developer, we gave up choosing 3DO. Even with a royalty, we’ll make no money other than the guaranteed fee." But for the future, he says, "We’ve had big companies like Philips come out with new products and fail. Sega is a video game company. They know their target market. 3DO needs to do the same thing.".

The Cartridge World.

If the availability of programmers does not dictate platform, criteria in choosing one might include the installed base, owner demographics, development cost or difficulty and the inevitable, arguable question of potential gameplay quality.

Installed Base.

Robert Botch, president of cartridge publisher U.S. Gold, thinks, "One million and growing is a good platform critical mass; 100,000 is too low. On the other hand, top programmers prefer to work with the latest technology. You want to keep them happy, so it may not be a business decision after all.".

Owner Demographics.

SNES players are skewed toward males 12 to 14 and younger. The older NES machines are being handed down to younger siblings, reports Capcom public relations coordinator Erin Skiba, so the publisher of Street Fighter II is still releasing NES titles such as Rescue Rangers. The Sega Genesis has been positioned more toward teenage and older audiences. Portable play by females and adults is surprisingly high. Nintendo reports almost half the Game Boy primary users are adults, of which nearly half are female.

Development Cost or Difficulty.

3DO provides a complete development environment, including clips from movies in the Time Warner library; it’s friendlier to non-programmers and costs about $15,000 if you count the Apple Quadra it runs on. The Jaguar offers "freedom, a lot more power with no operating system to get in the way," says Atari’s Brodie.

Gameplay Supported.

Some games require the more advanced platforms. Sticking with 16-bit performance, Capcom will not release Street Fighter II on any portables or CD, says Skiba. Sonic the Hedgehog offered unprecedented speed when it debuted with the 16-bit Genesis system, and Starfox made a similar impression in Jan. 1993 with its FX chip. High-end applications will no doubt showcase 3DO and Jaguar strengths shortly.

The cartridge world may seem frenetic, but it was designed to accommodate advancing technology and has done so remarkably well. Cartridges keep new technology compatible with the large installed bases of older platforms. T&E Soft’s John Eaton points out that when Nintendo introduced the FX chip, its Starfox game remained playable on the same SNES consoles. "It’s an interesting thing. It’s something that you can’t do with a PC, and you are not going to be able to do with, say, a 3DO machine. Once you’ve got that hardware, it’s a very expensive prospect to upgrade it. There are all kinds of entertainment products that a lot of people cannot play on their computers because they are not the latest and greatest.".

The PC World.

Kirk Green of Walt Disney Software sums it up, "We are inundated with so many different platforms. It is hard enough to keep up with something as well established as the home PC.".

Of over 125 million PCs and 10 million Macintoshes worldwide, 30 million are in U.S. homes, claims Steve Eskenazi of Alex, Brown & Sons; however, he doubts even half are used for games. Paul Wheaton of Dataquest notes that of the 12.5 million PCs sold in the U.S. in the past year, 3.4 million or 27% went to homes. Research supplied by Mark Pendergrast of the Software Publishers Association (SPA) shows that 1992 PC game purchases totaled $267 million for DOS, $31 million for Macintosh, and almost $30 million for Windows games.

Historically, game developers have been obliged to support graphics standards from Hercules to VGA, XGA, and SVGA; one, two and three-button mouses; extended and expanded memory; joysticks; and several flavors of sound card. Currently optional but well recognized as growth areas are Windows, CDROM, modem and network capability, full-motion video, decompression hardware and software, and voice recognition.

Every PC peripheral and software standard is essentially a mini-platform. Sometimes platform lifecycles are judged by nonintuitive standards. Gametek vice president of product development Gordon Walton relates how Software Etc. once discount-racked all PC games packaged with 5 1/4-inch disks. Many of the same titles with 3 1/2-inch floppies were still selling strong.

Computer games in North America sold $342 million at retail in 1992 by SPA reckoning-29% more than $265 million in 1991, and sales of $69 million for second-quarter 1993 were 22% above $56 million for the same period in 1992. Between 600 and 900 titles are released annually, of which the top 25 will sell 100,000 in a year, says Gametek’s Walton. Half break even, 15% make money, and, if it lasts for three months, the average title might sell 40,000. A classic like SimCity is approaching 1 million worldwide after four years. Civilization from MicroProse and Falcon 3.0 from Spectrum HoloByte, two resounding PC success stories from companies that happen to be merging, have sold 250,000 to 300,000 each.

The SPA reports that home education continues to beat out entertainment and personal finance for the strongest growth among its three consumer categories. Driven primarily by Macintosh software, home education sales grew 55% in the second quarter of 1993 over the same period a year ago, and total sales of $146 million in 1992 jumped 47% from $99 million in 1991. The ratio of entertainment to education sales was 2.65 to 1 in 1991, 2.34 to 1 in 1992, and less than 2 to 1 in the first half of 1993.

Available sales figures for Windows educational software were well over twice those for Windows entertainment software in 1993. Kirk Green of Walt Disney Software notes that edu-tainment is growing popular, even for preschoolers. "Mickey’s ABCs and 123s were just certified SPA Gold with 100,000 sales. That’s pretty good for a product aimed at three-year olds.".

Are the rules any different for cartridges and PC games in return policies, discount racking, and so on? Denny Thorley of Sega licensee Extreme Entertainment says no, "They are exactly the same. The only difference is the profit margins.".

Retailers.

"Games are like fish. If they sit on the shelf a week, they start to stink." Norman Weiss is sole proprietor of the Software Library in Orinda, Calif. He is a retailer. When it comes to tracking down those hoards of consumer dollars, the game industry relies on people like Weiss.

PC games are sold in about 15,000 stores in North America, video games in about 18,000. The top 10 retailers account for 75% to 85% of all PC and video game sales. For video games they are:

1. Toys R Us

2. Kaybee Toys

3. Wal-Mart

4. Target

5. Sears

6. Electronics Boutique

7. Software Etc

8. Egghead Software

9. Babbages

10. Blockbuster Video

Publishers have direct relationships with these retail outlets through inside sales forces or independent sales representatives.

Three primary retail channels for cartridge sales are:

- Toy stores (40% of sales)

- Mass merchants (40% of sales)

- Electronics and software stores (20% of sales).

The six primary channels for PC games, in approximate order of overall sales, are:

- Software specialty stores, such as Electronics Boutique, Software Etc, Egghead Software, Babbages, and G+G/Captron

- Computer superstores, such as Comp-USA, BizMart, CompuMart, MicroCenter, Computer City, and Incredible Universe (Tandy)

- Mass merchants, such as Sears, SAMs, K-Mart, Target, and Montgomery Ward

- Consumer electronics stores, such as The Good Guys, Circuit City, Silo, The Wiz, and Radio Shack (Tandy)

- Toy stores, such as Toys R Us and Kaybee Toys

- Discount warehouses, such as WalMart, CostCo, Price Club, and Office Depot.

Specialty stores continue to dominate, but computer superstores, discount warehouses, and mass merchandisers like SAMs and Target are gaining fast. Toys R Us does not sell PC titles at all in most of its stores, following a bad experience in the 1980s. Tandy is the opposite; although it does not stock video games, if Radio Shack is carrying your PC game, it means a sale volume of 7,000 to 28,000, and Tandy does not return products. Norman Weiss of the Software Library is tired of seeing his wholesale costs exceeding some sale prices of large chains. He and 60 other retailers are banding together to negotiate group purchasing arrangements.

Bob Botch of U.S. Gold says buyers want to see three things. "In order of importance: a marketing program behind a product, well-recognized licenses affiliated with the product, and quality in the product itself." LucasArts Entertainment enjoys a strong brand advantage, and marketing manager Mary Bihr agrees the game industry is more and more hits-driven. The trend is obvious, "Computer superstores and discount warehouses stock hits, not breadth." Gametek’s Walton confirms that 90% of relevant storefronts carry 25 PC titles or less. Video-game store buyers base their decisions more and more on the top 10 or 20 lists in consumer trade magazines like GamePro and Electronic Gaming Monthly, according to Brad Berglund of cartridge publisher Hot-B USA.

Retailers think in terms of turnover, returns, and sales per square foot. Turnover had better be at least one PC game per store per month or your title goes straight to the discount rack, says Walton of Gametek. Customers return about 8% of PC games, up to 50% for particularly bad ones, and they have no deadline for doing so. Publishers are expected to pay freight.

In the mall, nobody averages $1,000 per square foot in annual sales like the food servers or a very strong jewelry store. Clothing, book, and gift stores would be very happy with half that, but a Software Etc or Electronics Boutique should be able to turn $500 or more per square foot a year easily. To see sales per square foot and shelf space perfected, visit the video game aisle at Toys R Us.

Retailers collect people’s money in exchange for shrink-wrapped boxes. That said, it may come as a surprise how little retailers want to deal with people or products. They dislike walking customers through software installations, explaining AUTOEXEC.BAT and CONFIG.SYS files and how best to get past a puzzle. Worst of all, retailers hate selling something so bug-ridden it gets returned. More forgivable are hard-to-stack, oddly shaped boxes as long as they walk out the door.

Speaking of handling boxes, Maxis director of sales Ileana Seander lists just a few requirements retailers might impose on a supplier: special handling such as preticketing, merchandising support like counting stock in the field and automatically reordering, nonstandard pallets or skids (288 PC games fit a normal pallet; that’s two gross), and directly shipping to as many as 250 separate locations instead of a few central warehouses.

A retailer’s franchise comes from building relationships with the community. Egghead Software’s CUE Card program has almost 1.8 million members or about 0.75% of the population. That is a good-sized herd of disposable income to be able to track down.

- Where Video Games Come From?

- John Eaton, president of North American operations for Japanese-owned PC and cartridge publisher T&E Soft, explains where most video games come from. "The financial model that Nintendo and Sega use is to control all the manufacturing for the most part. They put the licensing fee on top of that." Every 16-bit cartridge costs a third-party publisher between $16 and $30, of which $10 is generally considered a licensing fee. An 8M cartridge with battery backup might cost $24 from Nintendo and $20 from Sega. Nintendo charges more, explaining why the Genesis Mortal Kombat costs $10 less at retail, and Nintendo cartridges cost $5 to $10 more."All the manufacturing" means just that: cartridge, label, manual, box, even warranty cards are made and assembled in Japan. A minimum first order is 30,000, and reorders are at least 10,000, except for European titles that must be translated into more languages. Until mid-1993, all licensees were limited to three releases per year; however, any game scoring high enough on Nintendo’s or Sega’s evaluation scale would not to be counted."You have to buy your cartridges from them in advance. You have to put up a letter of credit to make the order, and it takes three months for your product to get manufactured in Japan and shipped to the U.S.; you pay for it ‘on the dock’ at Kobe. It winds up in the store about four months after you ordered it, and you wind up getting paid about six months after you put up your letter of credit," says Eaton.A 50,000 initial shipment of a 12M cartridge like Street Fighter II with battery back-up would cost $25 or more-$1.25 million floated for six months. Even a bare-bones 30,000 run of the smallest cartridge would tie up nearly $500,000, and you never stop owning the cartridges, even after the shopper carries them out of Toys R Us.Eaton summarized, "There’s a tremendous inventory risk and a lot of money that gets tied up. A lot of people believe that there are very few software people actually making money in the cartridge business. And that’s one of the things that is going to drive the move away from the cartridge business and towards the CD-ROM, 32-bit business. Or that’s one theory.".

Distributors.

The biggest distributors of game titles are Ingram/Micro, Merisel, Baker & Taylor (parent of Soft Kat), Handleman’s, Avco, American Software, Beamscope Canada, and Fidelity. Nintendo maintains an official list of 10 to 20 recommended distributors.

"Our distribution mechanism is just a big engine," explains Ingram/Micro senior director Jeff Davis. To fuel this engine, Davis and a staff of eight evaluate 2,000 product submissions a year. "We look for titles with sales potential of $30,000 a month." At this self-proclaimed world’s largest wholesale distributor of microcomputer products, over 100 people compose a creative department for marketing and sales services whose duties include publishing an inch-thick phone book like catalog and sending it to every retailer serviced every month.

"Believe it or not, we try hard not to own our stock. Think in terms of selling through instead of selling to a distributor," advised Davis at a November 1993 seminar for the Multimedia Development Group of San Francisco. He meant it. Ingram/Micro keeps only about 22 days of inventory in stock. Distributors can bend the rules in their favor in many ways. Stock balancing lets them return older products to a publisher in exchange for newer releases; however, retailers returning products will be credited with a price in effect at the time of return. This difference could be between the $36 Weiss originally paid for the game and the $10 he eventually gets back.

Mary Bihr tells why LucasArts Entertainment recently chose a direct relationship with a distributor after being an Electronic Arts affiliated label for many years. "Baker & Taylor is the largest distributor of CD-ROM products today. With the new arrangement, we will not have to accept any returns, and they will place us in new storefronts including college bookstores and comic book stores. This works out well with our CD-ROM emphasis and the release of our first games based on comic books, the Sam & Max series by Steve Purcell.".

Distributors also prefer high prices and the bigger margins that go with them. This can put them in conflict with publishers, who want to grow their markets by driving price points down.

Publishers.

"In a whole new business, you can make up the rules," avows Tom McGrew, vice president of sales and marketing for the past six years at CD-ROM content publisher Compton’s NewMedia. In the absence of a platform provider pursuing the same agenda, he is right, and there is no Nintendo in the PC CD-ROM world.

Publishers deal extensively with everyone: consumer, platform provider, distributor and retailer, and of course developer, so we will examine each of these relationships.

If platform providers create a market, publishers can grow it. Compton’s drove the price point down to $39.95 for CD titles, and their sales climbed from $5 million in 1991 to $15 million in 1992 and $35 million in 1993. Says McGrew, "For two and a half years, we have been a market maker. We want CD-ROM to be ubiquitous. If you do not make it ubiquitous to the consumers, then you’ll suffer the peaks and valleys of the software business." As of November 1993, Compton’s International Encyclopedia had sold over 600,000 copies, including bundling with IBM, Compaq, and Apple.

Electronic Arts is an example of an assertive game publisher. It has always pioneered platforms and is now growing the multiplayer market with a four-way Genesis adapter, multi-sided strategy games like General Chaos, and eight page inserts in magazines like Electronic Gaming Monthly, promoting Electronic Arts sports tournaments around the country.

More than any other group except retailers, publishers make it their business to understand consumer behavior. Spectrum HoloByte conducted focus groups in the course of marketing Iron Helix, reports developer Drew Huffman of Drew Pictures. Such market research is par for the course. Warranty cards also help these game makers understand game players.

Publishers and platform providers can protect a market. Sega did so in 1993 by introducing a video game ratings system, but the best example is, of course, Nintendo. Stringent content restrictions, gameplay standards, title limits, and quality-driven quantity restrictions throughout the 1980s all ensured that no Atari fiasco would strike the ecosystem Nintendo had scrupulously nurtured. The new ratings system may amount to no more than free publicity for Sega, since no Nintendo title will ever get anything other than the equivalent of a G rating. This is a restriction at least 77 third-party publishers have been willing to accept.

Publishers’ fates follow those of their platforms. Incentives for the two are therefore usually aligned, but, in one recent case, the platform provider was at a rare disadvantage. Capcom undoubtedly cut into Sega sales when Street Fighter II for the Genesis, a genuine hit, was delayed four extra months from June to September 1993.

How do developers respond to the newest platforms? "It’s an interesting time right now in the business. Everyone is wondering where to put their bets. It’s risky for publishers and developers-but more so for publishers because they have more riding on it," observes developer Ken Balthaser.

Two-thirds of the 33 Sega Genesis licensees also support Nintendo platforms. Eight of 14 Sega CD third-party publishers do. Of the Jaguar’s 20 initial licensees, only two were either Sega or Nintendo third-party publishers, but six of the next nine announced by December 1993 are. With over 400 licensees and counting, 3DO has clearly positioned itself as more than a video game console.

To play the game, developers must agree to take all unsold merchandise, or they will not be asked back. Distribution consultant and former Broderbund marketing vice president Leigh Marriner says breaking into the retail channel is extremely difficult, partly because channel members demand protection against returns. Publishers must demonstrate that they will be around next year, that they will be able to make good on all unsold inventory, and that they are willing to do so.

The importance of two other publisher functions is waning, however: securing broad retail exposure, and fielding a product line. U.S. Gold’s Bob Botch says, "Getting more storefronts is not so much a priority; getting the stores to carry our whole line is." Marriner concurs: "1993 has been the first year to see some of the major publishers not get all their products picked up by the retail chains.".

Sometimes a publisher can dictate market terms. Compton’s NewMedia and Tom McGrew established a whole new margin level for CD-ROM products: "Content has more value than software. This is not the software business, this is a bastard child. Because of that, you can’t apply the old model. The software business is dead." How much of being a pioneer is obligation, and how much is opportunity? "We were the first with standardized packaging for CD-ROM products. Now guess what standard Sears and K-Mart are enforcing.".

Overly assertive publishers run the risk of antagonizing their resellers and jeopardizing future access to consumers. Norman Weiss resents the terms imposed by a PC publisher in the San Francisco Bay Area: "They’re like Nazis. They made me sign up for a program. I practically had to fill out my life story, then I got copies of every new product whether I wanted it or not. They wouldn’t even let me quit. To this day, returning even defective products to these people is a nightmare. It reminds me of IBM. Years ago, I applied to be an authorized retailer but they turned me down. Too small. Now they’re knocking at my door, begging to sign me up. I won’t do it. I can’t do it. For the last three years, I’ve told my customers never to buy IBM. I can’t go back on that. And besides, the quality isn’t there." What about that PC publisher’s products? "I only order them if I have a customer request.".

"Think mass market," exhorts Tom McGrew. There will be changes when it is reached, warns Norman Weiss. "You can’t buy Microsoft or Symantec products from the factory. Try it. They will refer you to a distributor or your local retailer. There are none of those toll-free 800 numbers you see in magazine ads for computer games, either.".

Publishers want a developer they can trust to deliver on the promises they make down the chain. Botch of U.S. Gold looks for developers who are proven or with whom he has worked before. If it’s time to release a new race game, whoever did his last one can be trusted. Mary Bihr of LucasArts says you need developers who accept creative direction, work to specification, and are reliable but most important of all is "to have an extremely creative development team who understand on a gut level what is fun.".

Either party can evolve into the other. U.S. Gold is building an in-house development team. Maxis grew from two men in a garage to a Broderbund affiliated label to a publishing house with its own affiliates. On the other hand, Sculptured Software reports no such publishing ambitions.

Developers.

Developers only deal directly with platform providers and publishers. PC game developers can still conceivably publish themselves, but the industry has matured well beyond the point where it is advisable. Video game designers must deal with either a platform provider, a licensed third-party publisher, or at least a design house. 3DO offers the only exception.

The wealth of video game platforms is a mixed blessing to developers. Older established houses like Sculptured Software see an opportunity to perform more ports, conversions of the same title from one platform to another. Younger firms like Alexandria face developing on what could be a losing platform: "The difference between 32-bit and 64-bit starts becoming meaningless. It’s ‘The Battle of the Bits.’ I’ll be so happy when the technology reaches the state where the output of the machine will allow TV-like quality. Then the consumer won’t care about the box, and we can get down to creating the content: that’s what we’re all waiting for." Ken Balthaser probably speaks for most developers.

Among PC games, there is a crop of new mini-platforms. Microsoft conducted free developer conferences around the country recently to jumpstart multimedia title development. With its hobbyist origins, Apple has always devoted significant resources to supporting developers of all varieties of applications. When Apple declared it intended to seed the market with CD-ROM drives at cost, it was good news for everybody, except CD-ROM-drive distributors.

The relationship between developer and publisher is probably the most significant for readers of this magazine. It can be an uneasy alliance. We know what publishers want from developers and why. Now let’s explore how developers feel about their publishers, how they ought to deal with them, exactly what publishers do to earn their keep, and (something every developer wonders) is there any alternative? Table 2 shows a glossary of terms used in distribution channels, that is, by publishers and each different distribution channel between them and the consumer.

"We’ve always agonized over marketing people’s actions," confides Darren Bartlett of the Illusions Gaming Company, a cartridge developer. "They change our names. They change our audience. We developers are a little older now than our target audience. They like cute animals. We like to blow things up. But our next game is about an autistic kid in a straitjacket." Mutual respect is the norm.

Remember three things when dealing with publishers. First, decide how much publisher you want: a half, a whole, or none at all. Second, limit all agreements with publishers and distributors by geographic region; don’t give up overseas rights, for example. Third, limit all agreements by platform; you wouldn’t want a cartridge publisher handling your DOS port.

Co-publishing or affiliated label arrangements are the half-a-publisher option, allowing developers and publishers to do what each does best, in theory. Maura Sparks of Pop Rocket, an Electronic Arts affiliated label, describes their relationship as "perfect for a small company, teaming up with all that marketing muscle." Developing exclusively for CD-ROM, the four-person Pop Rocket is looking to single-handedly create a music-video-adventure genre.

Three good reasons to co-publish are:

- You plan to become a publisher someday and want to develop a brand identity.

- You can afford to invest all the marketing, production, inventory, and service costs up-front.

- You want to maintain control and ownership of the product.

Co-publisher’s royalties equal their publisher’s. Alternatively, they might agree to sell to the publisher at a discount 5% to 10% better than they give any other distribution channel.

Drew Huffman offers the following advice to anyone negotiating with a publisher on the strength of his experience releasing Iron Helix through Spectrum HoloByte:

- Ask for help from family, friends, associates, lawyers, distribution consultants, and even competitors.

- Match the product to the publisher.

- Decide what you want, including the absolute minimum you will accept, and stick to it.

- Don’t lose your cool; it’s the publisher’s job to bargain with you.

- Understand what it is that you don’t know. Admit that to yourself, make a note, and find out later. Never commit to anything until you understand.

- Never make a decision for the wrong reasons.

For CD titles, former Broderbunder Leigh Marriner recommends the following affiliated label programs: Compton’s NewMedia, Sony, Apple, Electronic Arts, Maxis, Knowledge Adventure, Davidson, Edmark, Magic Quest, Paramount Interactive, Accolade, and Broderbund.

The whole-publisher approach is far more common. Sculptured Software controller Shelley Dahl says, "A lot of the design takes place in-house, but we work closely with a publisher. After all, it is their product." Indeed, most publishers originate 85% to 90% of their releases. As Cary Hammer of Unexpected Development explains, the average video game "starts with a publisher purchasing a license. They may then ask a developer to ‘do it all’ or to execute their own in-house design, to execute another party’s design, or just to do a straight platform port.".

Publishers rarely accept proposals from developers and even more rarely accept entire games done on spec. But sometimes a publisher will approach a developer with a license and ask if it has a game ready and waiting? They don’t just mean an engine but a whole game, where the graphics are added, and the game is done in a matter of weeks. Konami is one exception. Dealing exclusively with Japanese teams, it accepts only finished spec games from U.S. developers, but it no longer publishes PC games.

The mechanics of publishing are simple once a project is on track, but it is imperative to maintain close communication with all channel partners. Coordinating the logistics of product launches nationwide is at least one full-time job. The following prescription for a product launch, combining input from half a dozen publishers, illustrates some of the ways publishers earn their keep.

Publishers start contacting distributors at least six months prior to product release. A good way to think of it is one to two trade shows before release. So for a Christmas product, supply tidbits at the January and June Consumer Electronic Show. The dialogue starts in earnest three to six months before shipment. The publisher has alerted the channels to the new title, and you must assign it a stock keeping unit, a UPC code, street price, short description, and a ballpark time frame for when it will hit the street.

U.S. Gold’s Botch calls it a case of "Hollywood-style counter-programming; announce for the Fall, just not when exactly," as publishers jockey for position against each other’s releases. Nobody wanted to release a game too close to Mortal Monday, September 13, 1993, for example. The distribution channel will need sell sheets explaining the product and empty boxes for advertising photo shoots. The publisher spreads demo disks around to buyers, reviewers, and user groups. It makes plans for advertising and promotions in stores, magazines, at special events, with coupons, and whatever it can think of. Six weeks before shipment, the publisher takes a look at the market trends and competitive environment.

Hot-B USA’s Brad Berglund says you must ship by the end of October or early November to be on shelves by Thanksgiving, the start of the Christmas buying season. He and Botch agree that the Christmas quarter is as good as any two quarters’ sales, 50% to 60% of the entire year. Botch adds that January and February are good too, with people buying titles for the hardware systems they got over Christmas. Summer is the worst, thanks to longer daylight hours, vacations, and travel.

A typical figure for market development funds is 3% of wholesale volume, Sega’s Sonic the Hedgehog CD deducted off invoice. Sales performance incentive funds can be used to push the product further into the distribution channel. Remember, it’s the sales department’s job is to push a product into the distribution channel, and the marketing department’s job is to pull the product through. It can do that through advertising, promotions like contests, coupons, favorable press reviews, user-group-generated word-of-mouth, and of course a high-quality product starting with the box. Maxis sales director Ileana Seander says the two biggest factors affecting store buyers’ decisions are their relationship with the publisher and the box. But don’t go too far. Everyone in the distribution channel serves a pre-qualifying function. Handleman’s and Tandy will not carry games with overtly sexual, violent, or occult box art.

Gametek’s Gordon Walton also says product-centered advertising is a waste of money. If you must advertise, focus on company image and use home-buyer media or magazines like Computer Gaming World,Strategy Plus, and PC Entertainment, not trade, general interest, or computer industry magazines. Co-op ads in direct mail catalogues may be worth the money if mail order is a chosen distribution channel. Nintendo was thought to have spent $100 million promoting all titles this Christmas. Promoting Mortal Monday reputedly cost Acclaim $5 million. Your results may vary.

What are your alternatives? Self publishing is not recommended. Says Marriner, "Breaking into the retail channel is extremely difficult. It takes time to work distribution deals. Going it alone means less distribution. And, because you are marketing your company at the same time as the product, it will cost half again as much. But, most important is the pace of technology in this arena. By the time you get distribution, your product may no longer be state of the art.".

Distribution consultant Solange Van Der Moer of Infinity Partners paints a brighter picture. "Money still talks; you just have to turn up the volume. Match your product to the right target audience. Think out of the box. You’re providing information; it’s just a different medium.".

She likens Maxis to Wyndham Hill Records: "Over 12 years, they created the New Age category of music; the name of each new artist was irrelevant. You’ve already established an ongoing metaphor, and the consumer wants the next chapter." For distribution work-around, she finds potential for multimedia placement in museums, sporting goods stores, and even running the PC blockade at Toys R Us.

Three other viable distribution channels are worth considering.

- 1: Mail order accounts for 12% to 15% of IBM-compatible PC game sales but 40% to 50% for the Macintosh, of which 90% goes through three houses: Mac Zone, Mac Warehouse, and Mac Connection. "They will ask for ‘favored nation’ pricing, but don’t give it to them," warns Ingram/Micro’s Davis. "Keep a level playing field across all channels.". Multimedia publishing consultant Robert Risse of New Media Partners notes catalogues charge buy-in fees of $2,500 to $10,000 just to be listed and will request even more for advertising within their pages.

- 2: Shareware works. Take it from Scott Miller at Apogee, the bulletin board proprietor and shareware publisher that brought Wolfenstein 3D to market. It has sold over 20,000 copies since May 1992, generating over $1 million. Apogee has more than 20 titles, one to two dozen under production, 70 people collecting paychecks, and design teams from Redmond, Wash., and Canada to London and Sydney. Miller is particularly excited by a variant trend he calls "rackware," which he considers free distribution through thousands of grocery, stereo, and software stores as well as Wal-Mart, KMart, and Radio Shack. "All you need is a disk duplicating machine and screen shots for them to put in the bags and on the boxes.".

- 3: Electronic distribution is another topic that deserves its own article, but look for The Sega Channel soon, allowing game downloads one at a time into a special Genesis peripheral. Network games are viable already, however, and they allow group play. The main networks, their owners, and subscriber bases, according to The Wall Street Journal, are CompuServe (H&R Block, 1.4 million), Prodigy (IBM and Sears, 1 million), GEnie (General Electric, 400,000), and America Online (350,000).

GEnie has been the most aggressive of the big networks in courting game players, lowering its on-line charge to $3 per hour. The Multi-Player Game Network (MPG-Net) has around 10,000 subscribers. Delphi and National Videotex are in transition. The ImagiNation, formerly The Sierra Network, has 30,000 to 40,000 subscribers. Director of marketing Jeff Leibowitz says, "We are a games network, but games aren’t really the point: it’s playing games not against the computer but against other people. It can be a difficult message, because people don’t want to hear that they’re lonely.".

Assuming you stay with the more traditional distribution channels, what payoff can you expect? Consider terms, feedback, royalties, and margins.

Terms.

The vast majority of payments are advances against royalties, usually guaranteed so a developer will not end up owing anything if the product dies in the market. A schedule of eight payments is common: six milestones bracketed by signing and completion or approval payments. Weighting can be equal, heavier at signing and delivery stages, backloaded toward delivery, or otherwise.

A returns fund is maintained until a product is retired. Out of sales to a distributor, 20% may be held by the distributor for returns. This fund is adjusted every quarter, paid down over time, and closed out when the title is finally removed from distribution.

Whatever your publisher threshold was, Robert Risse of New Media Partners lists critical details you would be wise to either expect or insist on seeing in a contract:

- Publishers’ offers often come in the form of a term sheet. This is a good thing, pinpointing key terms without any confusing legal terminology.

- Sublicense fees should be computed at a higher rate than royalties. Your royalties on a publisher’s royalties can be up to 33%; for ancillary products like T-shirts and TV series, 7.5% to 10% is typical.

- Recoupment of the advance is negotiable; a recoupment percentage of 50% means developer royalties are paid out in cash as quickly as they are applied to pay down the advance.

- Right of first refusal on future titles should be diluted to a right of first negotiation.

- Payment schedules are negotiable. Typically developers are paid 30 days after publishers, which could amount to 120 days without cashflow. Advances might be made bigger, or payment can be adjusted.

- Ask for a commitment on how much the publisher will spend on advertising and promotion.

- After verbal agreements are obtained on key points, call in the lawyers. And read what they draw up to make sure it agrees with everything you negotiated.

Feedback.

PC games can expect a window of sales no more than six months before being discount-racked. Cartridges need to survive 60 days, and some last for years. LucasArts’s Bihr describes the market as "pretty aware; it has a quick adoption rate. We hope to recoup with the first shipout both marketing and development costs." Sometimes it takes two or three months after release to know if a product will succeed. Other times, in the case of X-Wing, the entire initial shipment of 100,000 was yanked through the channel, blowing out all forecasts and inventory, over the first weekend. Sell-in from March to December 1993 approached half a million, without even a Christmas.

Royalties.

Ballpark royalties are 7% to 15% of wholesale, or $1.00 to $3.00 per unit; they can be computed as a percent of sales or in dollars per units sold. Name developers get more. For example, a $50 suggested retail price game with a street price of $35 and wholesale revenue of $18 may return $2. A co-publishing developer would get closer to $9. A late developer might be penalized a point or two, so the rate might not be known until a project is completed. Sometimes there is a bonus for high volume sales.

Margins.

Handleman’s demands at least 60% off suggested retail price. Tandy/Radio Shack expects 62.5% if not 65% off retail, but will not ask you to accept returned products. Others average 55% off street retail. Street prices at Electronics Boutique and Software Etc or Babbages may dip 20% from $49 to $39, for example, affecting your wholesale revenue. The toy business is enviable, where all calculations are made off landed cost. Overall, retailers and distributors count on 10%, according to Jeff Davis of Ingram/Micro. Compton’s NewMedia takes 50% off suggested retail price for distributors, 45% for CompUSA, and 40% for retailers.

The Future.

I see three trends playing themselves out prominently in 1994, and two more operating in the background.

CD-ROM.

1994 will be the year of the CD-ROM. Cheaper and easier to manufacture than floppy disks or cartridges, each one can hold an unprecedented 600M of data. But the technology is imperfect; data transfer rate is bad, and seek time is worse. Even double-speed and triple-speed drives are slow. David Walker, a technical director at Electronic Arts and co-founder of the Computer Entertainment Developers Association, likens it to the data cassette of 10 years ago. By Eric Goldberg’s standards, it has already failed to be adopted by 50% of the populace within seven years, as the VCR, microwave and audio CD have been.

Nevertheless, the installed base of PC and Macintosh CD-ROM drives is estimated to have grown from half a million in 1992 to 6 million at year-end 1993 and to reach up to 20 million by the end of 1994. That would approximate today’s installed base of 16-bit video game consoles.

Tom McGrew reiterates the kind of success Compton’s NewMedia is enjoying with non-game multimedia titles: "This is not the book business, where 25,000 hardbacks is a success. We’re preselling 15,000 to 18,000 CD-ROMs at a time. CompUSA already has 120 CD titles on the shelf, and when we ask if they would be interested in another, they just say, ‘Ship it.’"

Capstone’s Angie Niehauf thinks "multimedia is what is going to change everything. Blockbuster and Sound Warehouse’s rental of software just like cartridges is expanding pretty fast. Everybody’s looking for CD product. The retailers are asking for it. Let’s see if the consumers are as excited.".

Rental.

Rental may be the way to jump-start new hardware standards. Blockbuster and other major video rental outlets will be renting cartridges and CD-ROMs as well as their players, including 3DOs, Jaguars, and Sega CDs. Nobody knows the net effect to date of cannibalization of potential cartridge sales vs. heightened awareness, but making state-of-the-art platform units available will raise the floor of installed bases if nothing else.

Interestingly, Electronic Arts has already experimented with a rental-only Sega cartridge. The John Madden Championship Edition was later rereleased exclusively via direct mail. If you consider arcades a sort of time-rental, then count Electronic Arts in on this trend yet again. They formed a coin operated division in August 1993.

Platforms.

What a war there will be in 1994 over platforms. Regardless of which ones survive, any hit games that materialize will be ported to the others over time. Therefore, in the long run, consumers will only be inconvenienced. Retailers and distributors are indifferent. For the developers, publishers, and providers, it could be deadly. So let’s squint once again into the horizon.

"The Jaguar lets you bang on the hardware and blow by the OS," says Atari’s Brodie. "It is a 55 MIPS computer with five processors, including a 64-bit RISC, 32-bit RISC, and 68000 chip just for joystick control and configuration setup." One advantage the Jaguar clearly has over the 3DO is a cartridge slot alongside its upcoming CD add-on. Plus, the Jaguar is still a cartridge machine, capable of assimilating new technology as T&E Soft’s John Eaton described. An MPEG decompression cartridge for fullmotion video will be available sometime this year.

3DO initially followed Philips’ CD-I into 2,000 to 3,000 stereo stores like The Good Guys, Circuit City, and Silo, positioned as a consumer electronic device. It suffered there. Disappointing from a sales standpoint, the distributions channel strategy may have helped establish 3DO as more than just a game box. A respectable first impression safely made, it is now sold at Capcom’s video game retail subsidiary G&G/Captron, among others, and will be rented at Blockbuster Videos.

Sega’s 32 or 64-bit CD game project, known as Saturn, is still an unknown quantity, but Alexandria’s Ken Balthaser ventures an opinion sight unseen: "I have to bet on Sega, just because of their track record. They’ve proven they can create new technology, they can introduce it, they can take the software and launch it. The question is, when will they launch. Like anyone with a successful product in the marketplace, you don’t want to kill the goose laying the golden eggs. So near term, two to three years: Sega. Long term: Sony or Matsushita, the big ones. When it becomes a commodity in the marketplace like TVs, they’re going to come out winners. You’ve got to go with the people who can produce mass quantities at low prices.".

SNK will release a NeoGeo CD attachment by the end of 1994, shortly before Sony’s CD game machine appears. Nobody’s willing to guess when or if Nintendo’s 64-bit Reality Engine will appear.

On the PC side, 80% of all software development in the DOS world is for the Windows environment. Yet the SPA reported only $3.7 million in Windows game sales out of $68.9 million total home entertainment software sold during the second quarter of 1993. Games will have to catch up.

Two less obvious trends will subtly affect the U.S. game market in 1994.

Overseas Markets. The worst thing that can happen in publishing is to push too many units into the distribution channel, according to Denny Thorley of Extreme Entertainment. It killed the Atari game industry, and even the 8-bit NES suffered a look-alike library in the late 1980s. Europe now offers a safety valve. Unexpected Development’s Cary Hammer, developing primarily for portables and the SNES, says the European market is taking off; Game Boy titles do even better in Europe than in America. With distribution favoring hits in the U.S., overflows have a place to go without bankrupting publishers or leaving distribution-channel partners holding stale inventory.

Impending Shakeout.

Even with expansive new game markets, there’s only so much room at the top. The casualties may not hit the ground until 1995, but Jeff Davis at Ingram/Micro already sees "way too much product looking for not enough distribution." Everyone agrees the industry is being hits-driven by licenses and marketing. Neither is necessarily related to gameplay quality, yet that is the keystone of this industry. The lessons of Atari and the 8-bit NES have been learned, but who knows if they’ll be remembered.

Dick Larkin of Hudson Soft voices the wisest publishers’ concerns when he says, "The challenge is how do you make it fun? That’s something we work on and work on and work on, and after all the pieces are put together, sometimes it’s still just not there." It was there for Super Bomberman. The multiplayer hit game attracted unprecedented interest in TurboTechnologies’s Duo and TurboGrafx-16, which Hudson Soft parlayed into exclusive rights to a five-player SNES attachment. Their Multi-Tap is now bundled in a Nintendo Super Bomberman Party Pak.

The man behind Sid Meier’s Civilization put it simply at the April 1993 Game Developers Conference. Interactivity is the special quality that computer games offer-not sound, not music, and not graphics. So given a limited budget, spend it on developing gameplay.

Cary Hammer feels the labor pool of experienced developers has grown big enough that he expects to see more spec development of cartridge games. Ileana Seander of Maxis admonishes any such developers to take the time to conduct predesign: "Look at the market; talk to retailers and focus-group consumers.".

Alert to the irony of her message coming from a company founded on the original game-without-a-category, SimCity, she adds, "The market has changed since five years ago. You have to know the competition, pricing, and just how limited shelf space is out there." Today, Maxis owns a large share of the Windows and an even bigger share of the Macintosh game markets. Don’t expect her to give them up easily.

Distribution and You.

Your ideas can become dollars. That’s the good news. The bad news is that the mix of inspiration and perspiration is no longer just between you, your muse, and the latest authoring tools. Everybody’s silver bullets must cross an economic landscape on the way to the firing range on a journey that is more and more by invitation only. To negotiate this terrain, it will help to have learned about the inhabitants and their perspectives, the rituals they follow and why, and what looms on the horizon for the entire ecology.

Packard’s Law still holds true. Every 18 months, computer chip price performance increases tenfold. That empowers the electronic entertainment industry with a dangerous ability to recreate itself every other year. It is happening again. The PC world keeps splintering across 286s, 386s, 486s, and Pentiums, with and without multimedia CD, sound, or video capabilities. Ken Balthaser could just as easily be speaking for PCs, as he views a similar landscape on the video game front: "It’s a watershed time, a transition period. 1993 was the last Christmas for 16-bit. Thirty-two is coming.".

Table 2 A Game Developers Glossary of Terms.

Affiliated label.

A developer who shoulders most of the monetary burden except gaining access to a publisher’s distribution channels, while keeping its own name on the box. Marketing assistance is negotiable, and independence is possible after developing a brand identity.

Bundling.

Including another product in a package, typically software with hardware. For example, a Virgin Games 7th Guest game was bundled with with Media Vision CD-ROM drives, Sonic cartridges were bundled with with Genesis consoles, and Crash ’N Burn cartridges were bundled with 3DO consoles.

Co-publish.

See "affiliated label."

FOB.

Freight-on-board indicates who pays shipping and how it is calculated. For example, "FOB Kobe" means the developer pays shipping across the Pacific.

Inventory.

Inventory is counted in dollars (wholesale), units, or days (before the games will probably get sold).

Listing fee.

What a mail order catalog charges a publisher to include a product.

MDF.

Market development funds; also called cooperative advertising.

OEM.

Original equipment manufacturer. See "bundling."

POP.

Point of purchase. Can refer to promotions ("impulse buy") or data collection.

Port.

A direct conversion of the a game title from one platform to another.

Price protection.

A distributor can collect the difference between its original purchase price and what the product has been discounted to.

Program.

An arrangement between a distributor and either a vendor (publisher) or reseller (retailer) that typically includes minimum sales volumes, return conditions, prices, or some rack jobbing. Programs are more prevalent in game software than business applications due to lower per-unit prices, $45 for a game vs. $250 for WordPerfect.

Rack jobber.

A distributor guarantees a dollar sales figure per linear foot of shelf space for retailers and performs merchandising like shipping, counting old and new stock, restocking, assuring proper placement, and stickering.

ROP.

Run-of-press, includes newspaper advertising, Sunday inserts, and so on.

Sell-in/sell-through.

Sell-in is filling the distribution channel by getting the product out the publisher’s door. Sell-through is consumers removing it from the distibution channel, hopefully not temporarily.

Sell sheets.

Descriptions of products written by publishers for retailers.

SKU.

Stock-keeping unit. This is how everyone in the distribution process keeps track of product and includes a specific titlemedium combination. The same game title for Genesis, SNES, Game Boy, and Game Gear would have four different SKUs.

To SKU.

To formally introduce a product to the market. This entails assigning a product a unique UPC code, listing a suggested retail price, and indicating a national street date with a time frame for release.

SPIF.

Sales performance incentive fund is a wholesale rebate paid to distributors for each unit sold through to the next distribution level, typically $1. Retailers are not usually "SPIFfed."

SRP.

Suggested retail price.

Stock balancing.

The right of a distributor to exchange older, slow-moving products for newer units from the same publisher.

Street price.

The price a consumer can get with a little looking, usually about 25% less than the SRP.

Terms.

Specific payment and delivery agreements.

Top of mind.

A marketing metric indicating how much publishers, distributors, and retailers are aware of a product’s existence.

Turnover.

Indicates how quickly inventory is replaced; divide retail sales by average inventory-the higher the better.

Credit.

James Paul Cooper sold decision support software to institutional investment managers for a global consulting firm. In 1978, he joined an Arizona computer game company instead of matriculating at the University of California. Since then, he has founded or co-founded several game and software ventures and acquired an M.S. in Industrial Administration from Carnegie Mellon University, where he taught marketing. He can be reached on Internet at 72147.2102@compuserve.com or through Game Developer magazine.

The 2 articles below were originally printed in: GAME DEVELOPER MAGAZINE, June 1994 issue.

CD-ROM: Package or Platform?

Now that game developers are faced with the largest storage device in the history of their industry, what are they going to do with it. Just as the command line gave way to the GUI, this shiny ethereal disk is muscling its dull, flimsy, magnetic ancestors out of the way. Lower manufacturing costs were one of the first benefits, as low as a dollar a unit. They were lighter to ship and harder to damage - no more damaged PC disks. They can be repackaged without threat of corruption or infection. And, as far as piracy goes, in the words of one developer, "Nobody ever downloaded 500MB from a BBS."

But are they, as they are marketed now, a software platform separate from disk-based games, or are they merely a storage medium and should be treated as such? When I ask developers what platform they're writing for, more are saying CD-ROM. When asked to clarify, they usually say, "Well, MPC2 and Macintosh first, then Sega CD and maybe 3DO or CD-I." Clearly, they're talking about high-end authoring systems manipulating either captured video or rendered images with CD-quality sound files - a development process where the main emphasis is on raw data that can be used across a variety of platforms.

Playability

The problem is, many newer CD-ROM games have the playability equivalent of Pong games with captured video images of professional tennis players and CD quality sounds of bouncing balls. This is because high-level authoring systems available can deliver the kind of performance that is needed on every platform, so most cross-platform CD-ROM's rely on a variety of kludges, just to get a simple game manipulating video to work.

Games need to be more tightly integrated into specific platforms to get good playability, and more of the CD-ROM's cross platform identity will be lost.

Stand or Fall?

The potential of the CD-ROM as a platform is tremendous because it is viewed as a superset not subset of the existing computer game industry. Everyone's hoping that nontechnical people who would never buy an Ultima, flight simulator, or Doom will be willing to buy a CD-ROM game designed to appeal to a wider audience - changing the computer into interactive VCR. If these technical neophytes' first experience is a bad one, for $60 a disk, they're not going to continue making the same mistakes.

It will be this next year as these consumers make their first CD-ROM purchases that will determine the shape of the industry. If CD-ROM games are able to vary more in subject matter than traditional computer games, retain their platform independence, and capture new demographics, they will attain the status of new platform. If not, they will just be another means to get product to market and will just be another label on the side of the box. Regardless of the outcome, it looks as if the CD-ROM is here to stay.

Alexander Antoniades.

Associate Editor

Get Your Game on a CD-ROM.

- CD-ROMs have blown open the game market with the potential for high-end sound, video, even multimedia. But beware the pitfalls of technology! You need to plan carefully to create a superior game.

by Guy Wright

The concept of developing games specifically for CD-ROM or porting existing products onto CD-ROM is appealing and a bit frightening. There are advantages to using the CD-ROM as a delivery platform, and there are technological barriers as well.

Your managers see CD-ROMs as an economical alternative to floppy disks, and the lure of 550MB of storage to play around with makes programmers drool.

Unfortunately, most companies are unfamiliar with the practical step-by-step processes involved with actually producing a disc - and what the pitfalls are. I will guide you around some of the pitfalls inherent with CD-ROM development and demystify the process somewhat.

- Cool graphics are just one advantage to writing your game specifically for CD-ROM. But a high-end clip like this can cost a lot in terms of money and staff resources - several hundred clips can put your project out of business. Carefully planned and placed, though, you can make efficient use of your resources and still come out with a visually superior game.

Not Just for Aerosmith Anymore.

While CD-ROM's have been around since the mid-1980s, most products produced for the medium have been fairly plain, unimaginative text-based reference works. Almost 90% of the discs available are plain-vanilla DOS products with no graphics, sound, and animation. Only in the past few years have CD-ROM players penetrated the market enough to make broad-based consumer-oriented software financially viable.

Not that a single dominant platform has emerged. CDI, 3DO, SegaCD, CDTV, CD-32, Jaguar, FM-Townes, and a few other TV-top or stand-alone systems are still trying to establish a foothold in the home market (none is a clear winner yet), while Apple, IBM, Tandy, Atari, and Commodore all support CD-ROM drives as add-ons to their PC products.

There are also hybrid systems like Laser Active just introduced last fall that plays video laser discs, game cartridges, and CD-ROM-based software. All these systems have their idiosyncrasies when it comes to writing code for them, but fortunately there are some commonalities.

One common thread that runs through these systems is that the discs all adhere to the ISO-9660 standard. The ISO standard describes the physical layout of data on the surface of the disc and some of the structure the data must conform to. Beyond that, it is up to the individual system firmware or device drivers to read that data and translate it into a form the native operating system can understand.

In other words, all CD-ROMs that adhere to the ISO-9660 standard can be read by all CD-ROM players. That's the good news. The bad news is that, like Apples to IBMs, just because you can read the disc does not mean your system can do anything meaningful with the data. Animation files saved in Commodore's ANIM.7 format still cannot be played on an Apple Macintosh; code written for the Windows environment won't run under OS9 (the basis of Philip's CDI operating system).

As the developer, you may have to write different versions of your program for each system. You can store multiple versions on the same CD-ROM, and each platform should be able to use the same disc. The other bonus to the ISO standard is that, unless you really need to write code "down to the plastic" (for a custom video playback routine or to squeeze the absolute maximum performance from a disc), you don't really have to worry about file structure. (Youdo have to worry about track layout and organization, but we'll get to that a bit later.)

The Need for Speed.

Another common element to all CDROMs is that they areslow. A single speed CD-ROM drive boasts a whopping data transfer rate of just under 150K per second. Compare that to a medium speed hard-disk drive with transfer rates approximately 10 times faster. Another perhaps more crippling factor is seek times. When CD-ROM drive vendors claim a 150K transfer rate (or double, triple, or quadruple rates), they somehow conveniently neglect to mention that almost all CD-ROM drives have atrocious seek times. If you are just loading data from a text-only reference CD, it doesn't make that much difference. For game developers who want to load sound, animation, video, and data in as close to real time as possible, those seek times can be a nightmare. Also, different systems vary the default chuck sizes.

Let's look at a worst case scenario. When you send a read command to the drive, it must first move the read head to where it thinks the file probably is. It reads a 4K or 8K header chunk (depending on the firmware or hardware configuration) to see if it's got the correct file. If it's the right file, it has to wait for the disc to spin around again, then reads 80K chunks (regardless of how big the file is) until the entire file is read.

Let's say you are reading a 30K file. Seek times on some CD players, going from the outer edge of a disc to the inner, can take up to 1.2 seconds! Yes, seconds! (I have personally worked on systems like this. TV-top systems trying to appeal to the masses and are highly cost conscious tend to put the least-costly and thus least-efficient drives in their machines.)

So, 1.2 seconds plus .03 sec. for the header read, plus .5 sec. for the actual data (remember, it reads an 80K chunk no matter how big or small the actual file may be), and we are at 1.73 seconds to read a 30K file! All this is assuming it hit the correct spot the first time. If not, add a bit more time. Suddenly our 150K per second transfer rate has dropped to 20K per second. Imagine you are trying to double-buffer sound files while loading something else, and you begin to see where the biggest CD-ROM bottleneck occurs.

Granted, this is a worst case situation, but ignore this warning at your own peril. You may think your program is fine until you start getting irate calls from people who say that the audio is garbled or the QuickTime video sequence is annoyingly jerky on their system.

If you are producing a product for a TV-top system like 3DO or CDI, there are ways to get around some of these problems. You can force the drive to read certain size chunks (assuming you know exactly how big each file is before you issue a read command) or just tell it to start dumping raw data into RAM where your code will sort everything out on the fly. But if you are developing for a PC platform where you don't know what kind of CD-ROM drive the user is likely to own, you have to resort to other tricks.

The first, simplest, and most valuable trick for teasing performance out of a CD-ROM drive is physical layout of the data on the disc. If you are careful about the physical layout of the files on the disc (keeping sequential files close to each other), you can minimize the seek time problems. If the read head doesn't have to travel as far, it won't take as long to start transferring your data into RAM.

Of course, you must change some traditional ideas about how you organize your data during development. For instance, don't put all your sound files in one directory, your pictures in another, and your animations in a third. When you transfer those directories to a CD disc your files will end up far apart on the disc, causing longer seeks.

Instead, put sound, picture, and animation files that will be used at the same time in their own directory. That way you can be certain they will be near each other on the disc when it comes time to read them. For some systems, there are even optimization utilities that will track file use during emulation and tell you which files should be closer to each other.

Down to the Plastic.

This is a good time to run through the traditional steps in making a CD-ROM disc.

Step 1: Design your product.

You should already have a good idea about how to do this (if not, you probably shouldn't be in the business). What do you want? What will it look like? Create a wish list and go back and modify it based on cost, resources, development time, and so on. It's tempting to think of a CD-ROM as a panacea for all the problems you face with traditional game design and production. But before you finish your design, look at your original idea and some of the cold, hard numbers.

If you want video in your product, you must invest in a whole new world of hardware that most of the programmers on your team don't know anything about. There are VCRs, editing decks, SMPTE time code generators, editor controllers, cameras, and, of course, actors, costumes, scripts, lighting, audio, directors, and video editing. I'm not saying you shouldn't include video, but think back to those cheesy car-dealer commercials on your local TV channel. Those obviously shoe-string budget, low-quality, 30-second spots cost tens of thousands of dollars to produce!

If you think you can do it for less, take a look at your own home videos and decide if that is the quality you want in your new game. Call a few video production companies, costume houses, and so on, and run some of the numbers yourself. You may end up spending $100,000 or more for a few minutes of video before you get it into the computer.

Once you have the video, you have to capture it and convert it into a video format for your particular platform. QuickTime and Video For Windows charge a run-time fee per product (and you can't count on your buyers already having them). In addition, there is the cost of the video capture equipment and its learning curve. You can plan on adding a few months to the development cycle if you are including video in your game.

If you can overcome all these obstacles and manage to get the video into the computer, a good rule of thumb is to figure on a megabyte of storage for each three to five seconds of video. You can have a spiffy intro video of two minutes that should only take about 60M (in a small window, that is, not full-screen and not quite VCR rental movie quality).

If you consider that a 70-minute movie can barely squeeze onto a CDROM using MPEG hardware compression, you begin to realize why there aren't a lot of interactive video games out there (exactly none at last count). But don't let all this discourage you. A few well-placed 10-second clips here and there can mean the difference between award-winning software and just another shovelware port. Investigate the problems, costs, and eventual benefits of video, and then make up your mind whether to include it or not.

If you want a complete CD-quality soundtrack, there is more bad news and good news. CD-quality audio (at a 22KHz sample rate in stereo) ends up gobbling CD-ROM space as hungrily as video. (That's why you can only fit 70 minutes of music on a CD-audio disc).